So you want an easier way to fill out your 1099s? We’re here for you. We’ve taken the stress and hassle out of PDF 1099 software with a better way. But before we dive in, let’s go over exactly what 1099 reporting is so that you have a better understanding of how this 1099 software can help your business.

Income tax season is just around the corner, and every year more than 60% of Americans have to deal with this hectic time of the year. While you might be thinking that it can’t be avoided and there is no way to escape it, in reality, you can make your life easier by choosing the best 1099 software. A 1099 is a form given to independent contractors or freelancers.

1099 software for 2020

The new tax law requires many businesses to file 1099s, but you may need to file a lot of them. It can be hard to keep up with all your 1099s and the information they require.

1099 software for 2020

Income tax season is just around the corner, and we all know what that means: lots and lots of paperwork. If you’re a small business owner or independent contractor and you’ve been using 1099s for your clients in the past, it’s time to start thinking about what you’ll do this year.

We’re here to help. We’ve got some great new features that will make it easier than ever for you to manage your 1099s, so let’s go over them real quick:

-Integration with QuickBooks! You can now import all of your client data directly from QuickBooks, so there’s no need to worry about double-entry or having to enter data manually by hand.

-Automatic filing! Our new system will seamlessly file all of your 1099s with the IRS so there’s nothing left for you to do but sit back and wait for your refund—and keep working on growing your business!

1099 software for 2020

Background

The IRS lets businesses annually file their 1099 forms electronically (also known as e-File), instead of manually printing paper copies and sending them to the IRS. For more details, check out the IRS’s Filing Information Returns Electronically.

Keep in mind that when you e-File, you don’t need to file the summary Form 1096—this is only needed when filing paper copies.

As a Patriot Software Accounting or Payroll customer, Patriot offers an option to electronically file (e-File) your 1099-MISC and 1099-NEC forms with the IRS.

If filing 1099-MISC forms, you can also e-File with states participating in the combined federal/state e-File program. See the resource page What Is Your 1099 State Filing Responsibility for the 1099-NEC?

E-Filing with the IRS is separate from printing and distributing 1099s to your contractors. At this time, you must individually print and send paper 1099s copies to each contractor.

Is there a cost to e-File?

Patriot will e-File 1099s for Full Service Payroll customers who are paying contractors through payroll at no additional cost for 2020 1099s and later years.

If you have Accounting Premium, Accounting Basic, or Basic Payroll, here are the filing fees:

| Number of 1099s | Fee |

|---|---|

| 1 to 5 | $20.00 |

| 6 to 35 | Additional $2.00 per 1099 |

| 36+ | No additional charge |

Annual e-Filing Fees

The fee will be charged to your credit card at the time you e-File. If your credit card charge fails, you must repeat the e-Filing request process.

If you choose not to have Patriot e-File your 1099s to the IRS, you are responsible for filing your 1099s and 1096 with the IRS and any required states.

IRS filing deadlines

Although the e-Filing window is open through March 31, your deadline might be sooner.

Form 1099-NEC is due to the IRS by January 31 (both paper and electronic). If you file after the deadline, you are responsible for any IRS late penalties.

Form 1099-MISC is due to the IRS by February 28 (paper) or March 31 (electronic). But, give your vendors their copies by January 31.

Important information about the state e-Filing program

Most, but not all states with income tax participate in the combined e-File program. States with no income tax do not participate.

- If a vendor is located in a state with income tax that does not participate, it will be your responsibility to file their 1099 with the state. You can still download a paper 1099/1096 form to send to the state via mail.

How to e-File Your 1099s in Patriot Software

Before you e-File your 1099s, make sure you have done the following:

- Check that you are within the January 1 to March 31 window for the prior year. Otherwise, you need to wait until the e-Filing window is open.

- Go to Accounting > Your Company > Vendors. Confirm each vendor who needs a 1099 is set to “Yes” under “Create 1099.”

- Go to Reports > 1099 Contractor Reports > Missing 1099 Information to make sure all vendors have either their Employer Identification Number (EIN) or Social Security number entered.

- Go to Reports > 1099 Contractor Reports > 1099/1096 Summary to confirm the vendor payment amounts for the year are correct. These amounts will print on the 1099 forms and be reported to the IRS.

Once you are ready to e-File:

- Go to Reports > 1099 Contractor Forms > e-File 1099s

- If you are viewing this page between January 1 and March 31, confirm you have completed the tasks and click “I’m ready to e-File.” If you are not viewing this page between January 1 and March 31, you will see a message that e-Filing is closed for the year. If you have already e-Filed, you will be redirected to the “Create and View 1099/1096 Forms” page.

- Review your e-Filing fee. Patriot will charge this fee to your credit card once your 1099 e-Filing has been submitted to the IRS. Click “I Agree.”

- Review the state for each vendor. Under the Combined Federal/State Filing Program, the IRS will automatically share your 1099 information with the appropriate states for no additional charge. If a vendor is located in a state that does not participate, “Not Supported” will be selected. If needed, you can change the state here. The dropdown list will only show participating states. However, you can still download a paper 1099/1096 form to send to the state via mail.

- Confirm your 1099 information a final time before submitting for e-File. You will see a summary of each Vendor, the 1099 reported dollar amount, and whether the 1099 is also being filed with the state. Check the box to agree that the information is accurate and agree to the e-Filing fee, and click “Submit.”

- You will see a “success” message that your 1099 e-Filing was submitted.

- Your status will show “Pending” until we upload your 1099s to the IRS. When this happens, your status will change to “Uploaded.”

Print and distribute your 1099 forms

You still need to print hard copies of each 1099 to give to your vendors:

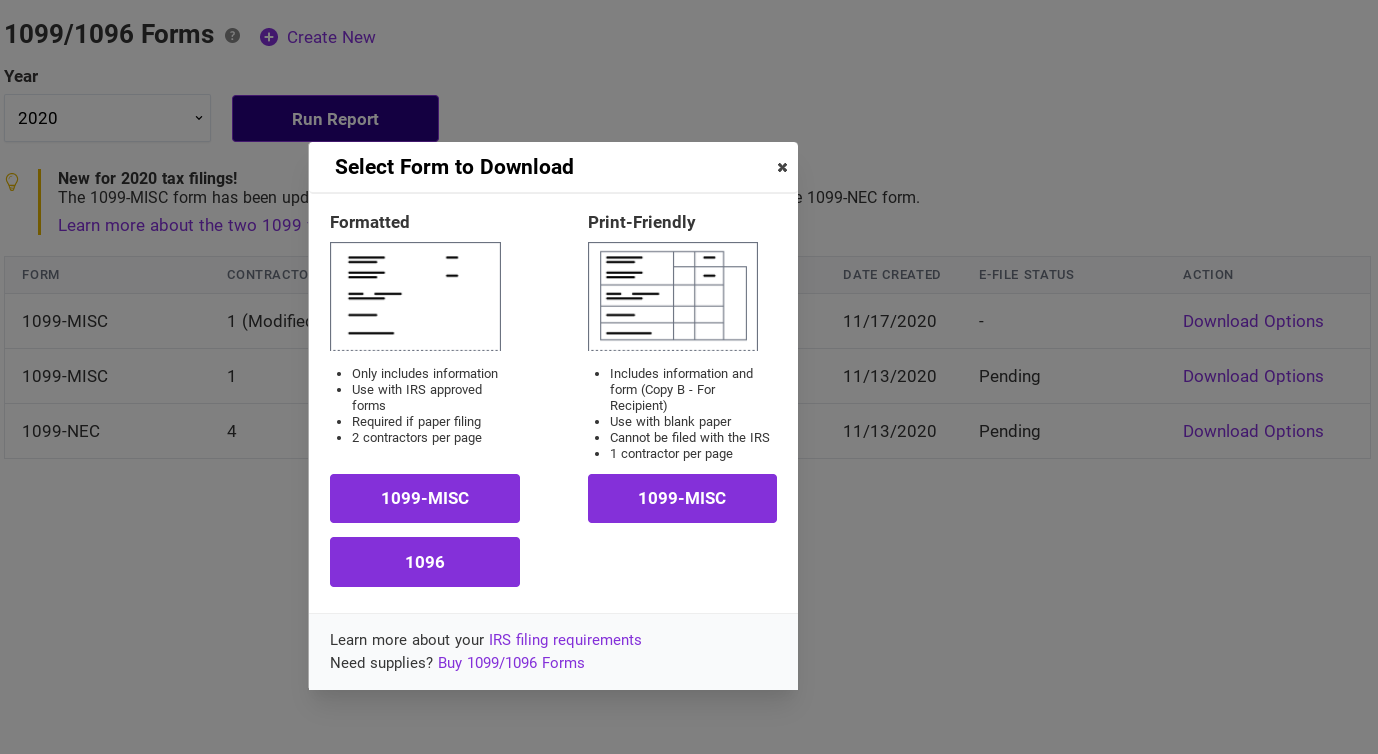

- Go to Reports > 1099 Contractor Forms > Create and View 1099/1096 Forms

- Click “Download Options” in the row with the 1099 type (1099-NEC or 1099-MISC) you want to print. You have two printing options:

- Formatted: This PDF only contains the information to be printed on a pre-printed IRS Form 1099.

- Print-Friendly: This PDF contains the entire form that can be printed on blank paper and distributed to your contractors and vendors.

If You Need to Make Corrections or Additions After You Have e-Filed

You can only go through the 1099 e-File process in the software one time per year. If you need to make a correction after you have submitted your e-File, you must manually file a corrected return to the IRS. See the following articles for more info: